Recently, a scam involving fake letters from a law firm called Fleming, White & Burgess Lawyers. These letters claim the recipients are allowed a large life insurance payout. However, the more proximate look shows this is a clever fraud meant to mislead people.

This post explains the details of the scam, how it operates, and how people can protect themselves.

Fleming, White & Burgess Lawyers Life Insurance Letter Scam Overview

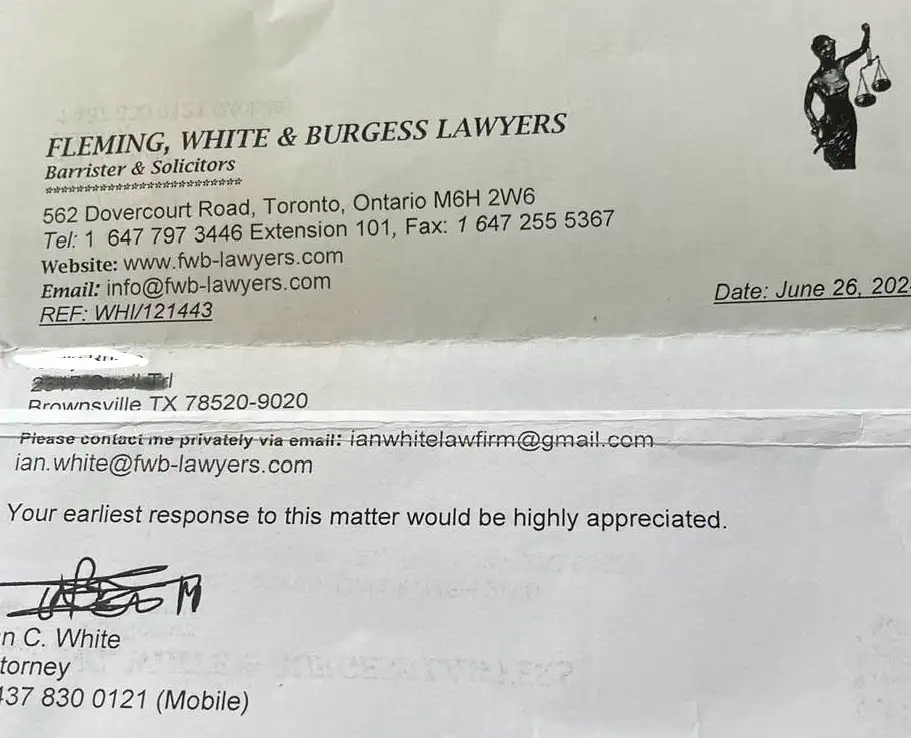

The Fleming, White & Burgess Lawyers Life Insurance Letter scam begins with a letter that appears to be from a legitimate law firm. The letter claims that a deceased individual with the same last name as the recipient has left behind a substantial life insurance policy.

The letterhead and professional language are used to make the letter seem authentic. To attract the recipient, the letter offers a share of the supposed life insurance payout.

The letter looks like this:

This offer of easy money is designed to attract the recipient into responding. The letter creates a sense of urgency and prevents the recipient from thoroughly considering the offer or seeking external advice.

Once contact is made, the scammer requests personal information from the recipient, such as their full name, address, date of birth, and banking details. In some cases, they may also ask for an upfront payment to cover “legal fees” or “processing costs.”

After the recipient provides their personal information or money, the scammer disappears, leaving the victim helpless to identity theft and financial loss.

Warning Signs of Fleming, White & Burgess Lawyers Life Insurance Letter

There are many concerns about this letter has been given by the users. Here are some warning signs that you can consider to check these types of scams.

1. Unrequested Contact

Receiving an unexpected letter from a law firm about a life insurance policy should raise immediate suspicion. Legitimate claims involving large sums of money are not communicated through unsolicited letters.

2. Secrecy and Urgency

Legitimate legal matters do not require immediate action without proper verification. The focus on confidentiality and urgency is a tactic to prevent thorough research to check if it is legit or a scam.

3. Requests for Personal Information

The ask for personal and sensitive information raises concerns. This phase of the scam is particularly dangerous because it leads to identity theft and financial exploitation.

How to protect yourself from these Scams?

To protect yourself from Fleming, White & Burgess Lawyers Life Insurance Letter scams and similar scams, here are some steps that you should follow.

Verify the Source: If you receive an unrequested letter claiming a life insurance payout, contact the law firm directly using verified contact information from official directories, not the details provided in the letter.

Do Not Share Personal Information: Never give out personal information or make payments to unknown entities without thorough verification.

Be careful of Unsolicited Offers: Treat unexpected offers of large sums of money with caution, especially if they require secrecy or urgency.

Report the Scam: If you suspect a scam, report it to local authorities and consumer protection agencies, such as the Federal Trade Commission (FTC) in the U.S. This helps prevent others from falling victim.

FAQs

In Canada, unclaimed life insurance policies are eventually transferred to the provincial or federal government if beneficiaries cannot be located. The government then holds these funds, and rightful claimants can still come forward to claim the policy benefits.

To spot a fake law firm in Canada, check the firm’s credentials through official provincial or territorial law society directories. Verify the lawyer’s status and contact details, and look for any disciplinary actions.

Jason Thomas is a Computer Science student specializing in AI & ML, dedicated to safeguarding individuals from online threats. Passionate about exposing internet scams, Jason spends his free time identifying and reviewing various fraudulent activities and unethical materials. With a unique blend of theoretical knowledge and practical application, he is a valuable contributor to the fight against online fraud. His commitment to technology and programming fuels his mission to protect people from scams and enhance internet safety for everyone.