When it comes to protecting your personal information, understanding the latest scams targeting everyday activities is essential. One such scheme currently preying on Minnesota drivers is the Minnesota Express Lane Payment Reminder Scam.

In this post, we will review the Minnesota Express Lane Payment Reminder Scam, how this scam works, and what to do if you fall for this scam.

Minnesota Express Lane Payment Reminder Scam Overview

The Minnesota Express Lane Payment Reminder Scam is a deceptive operation aimed at motorists who use the E-ZPass (formerly MnPass) lanes in Minnesota. This scam involves sending fraudulent text messages or emails to unsuspecting drivers, falsely claiming they owe money for using the express lanes.

The messages appear to be from the Minnesota Department of Transportation (MnDOT) and urge recipients to pay a fee immediately to avoid accumulating late charges.

These communications are fraudulent and have no connection to MnDOT. The scammers’ objective is to steal sensitive personal information, such as credit card details, or to trick victims into clicking on malicious links that could compromise their security.

How Minnesota Express Lane Payment Reminder Scam Work?

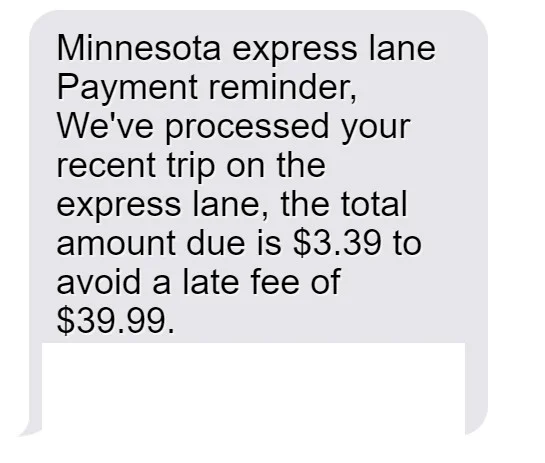

The Minnesota Express Lane Payment Reminder Scam operates by sending out text messages or emails that mimic official communications from MnDOT or the E-ZPass program.

These messages looks include the message: “Minnesota express lane Payment reminder, We’ve processed your recent trip on the express lane, the total amount due is $3.39 to avoid a late fee of $39.99.“

The scammers also contact victims by phone, pretending to be MnDOT representatives. During these calls, they pressure the victims to make payments over the phone. These calls originate from random phone numbers, sometimes from area codes outside of Minnesota.

What to Do if You Fall for the Minnesota Express Lane Payment Reminder Scam?

If you have been tricked into providing your credit card information or clicking on a suspicious link, it’s essential to take immediate steps to protect yourself:

1. Contact Your Financial Institution

Reach out to your bank or credit card company to alert them that your information has been compromised. They can help you secure your accounts, which may include issuing a new card.

2. Check Your Accounts

Regularly review your bank and credit card statements for any unauthorized transactions. If you spot any suspicious activity, report it to your bank immediately.

3. Change Your Passwords

Update the passwords for any accounts that could have been accessed by the scammers. Be sure to create strong, unique passwords for each account to enhance your security.

4. Report the Scam

File a complaint with the Federal Trade Commission (FTC) and the FBI’s Internet Crime Complaint Center (IC3). Reporting the scam can help authorities track down the perpetrators and prevent others from falling victim to similar schemes.

Laura Kemmis is a passionate trendsetter and reviewer, dedicated to researching the latest scams and frauds while sharing her insights with the world. She provides valuable information to keep her audience aware and informed about the latest scams. Additionally, Laura discovers and analyzes trends in fashion, technology, and lifestyle, offering a fresh and honest perspective in her reviews.