In the quiet corners of America’s economic engine, a hidden force has been steadily fueling inflation—unchecked corporate pricing power. It’s not the loud proclamations of politicians or even the intricate maneuvers of central banks that stand at the heart of this phenomenon.

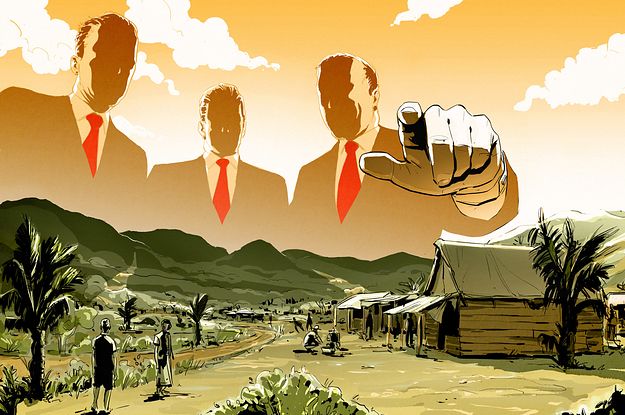

Instead, it’s the quiet decisions made in corporate boardrooms: How much more can we charge, and how much will they pay?

This is a story of how corporate greed, cloaked in market dynamics, impacts the price of everything you buy—from groceries to gas.

The Spark Behind Rising Costs

Picture this: The pandemic sweeps across the globe. Factories shutter. Supply chains, once smooth highways of goods, become broken trails. Prices start creeping up, and at first, it makes sense. A loaf of bread costs more because it costs more to make and ship it.

But then something strange happens. Costs stabilize, yet prices keep climbing. Corporations, noticing how little resistance they face, seize the moment. Blame inflation, blame the pandemic, blame anything—but keep raising those prices. After all, consumers have already adjusted to paying more.

The Real Winners of Inflation

Behind closed doors, CEOs and shareholders are smiling. Record profits pour in quarter after quarter. Publicly, companies cite “rising costs” to justify their price hikes. Privately, they’re celebrating the highest profit margins in decades.

Take the food industry as an example. While producers claim to be struggling, some companies post profits that far outpace their pre-pandemic highs. Critics call it “greedflation,” a term born from the realization that corporations are using inflation as a convenient cover to fatten their bottom lines.

The Consequences for Everyday Americans

For families on tight budgets, these rising prices aren’t just numbers—they’re choices. Do you fill the gas tank or buy fresh produce this week? Do you pay the rent or cover unexpected medical expenses?

These struggles are especially pronounced in industries where competition is limited. Fewer players in the market mean fewer alternatives for consumers. Want internet? Your options are likely limited to two or three companies—each charging higher fees year after year.

The Role of Policy

It’s tempting to point fingers at government policies. Critics argue that stimulus checks and low-interest rates flooded the market with cash, overheating demand. But others counter that corporations, not consumers, are the true culprits.

Here’s why: Even as production costs have leveled off, companies haven’t lowered their prices. Instead, they’re investing in stock buybacks, executive bonuses, and dividend payouts—all while blaming inflation for their decisions.

Solutions to Tame Corporate Power

The answer lies in accountability. Increasing transparency about corporate pricing strategies is crucial. So is enforcing antitrust laws to prevent monopolistic behavior. When companies are forced to compete, prices naturally drop.

Tax policies also play a role. By limiting tax breaks for stock buybacks and imposing higher taxes on excessive corporate profits, we can curb the unchecked greed that drives up prices.

The Bigger Picture

Unchecked corporate pricing power isn’t just an economic issue—it’s a social one. It shapes how Americans live, what they can afford, and the opportunities they can access. It’s a story that affects us all, whether we realize it or not.

As we navigate the complexities of inflation, one thing becomes clear: Blaming consumers or governments alone won’t solve the problem. To truly address the issue, we must look at the decisions made in the boardrooms and demand better from those who wield the power to set prices.

This is more than just a story of dollars and cents. It’s about fairness, accountability, and ensuring that prosperity isn’t reserved for the few at the expense of the many.

Clark is a 26-year-old expert working for consumer protection, Clark has dedicated years to identifying and exposing fraudulent schemes. He is working with NGOs to help people who are victims of scams. In his free time, Todd plays football or goes to a bar.