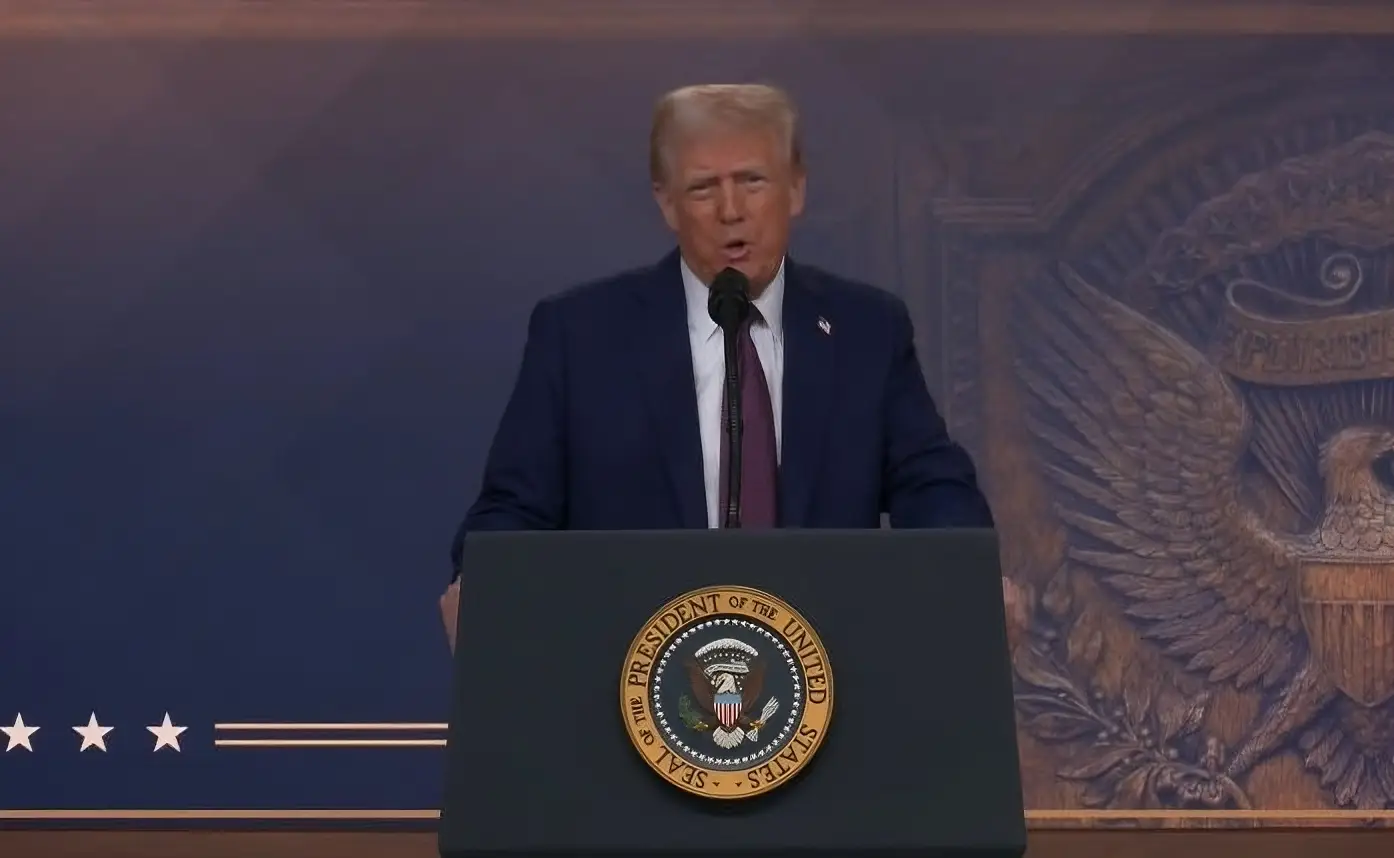

President Donald Trump’s recent request to the Bank of America CEO has turned heads. He called for a more inclusive banking system, claiming conservatives are being unfairly treated.

This bold statement has ignited a fierce debate, forcing both the financial and political worlds to take notice.

Are Banks Discriminating Against Conservatives?

Trump’s claim revolves around an alarming possibility: are banks sidelining customers based on their political beliefs?

According to him, conservatives, especially those aligned with his MAGA movement, face rejection for loans, accounts, or services.

While his words struck a chord with his supporters, the lack of concrete evidence left skeptics asking tough questions. Could politics truly dictate who gets financial access?

Public Reactions

Social media platforms have become battlegrounds for this debate. On Twitter, Reddit, and beyond, people are sharing their views and personal anecdotes.

Key themes have emerged:

- Is it Politics or Policy? Some argue banks don’t factor in politics but focus on credit scores and banking behavior.

- Fears of Bias: Others claim a silent trend exists, where personal beliefs influence financial decisions.

- Expert Opinions: Many financial insiders stress that political affiliation isn’t tracked in traditional banking processes.

These discussions highlight a growing divide between perceived experiences and systemic policies.

How U.S. Banks Ensure Fairness

Banks across America follow strict anti-discrimination laws. Federal regulations prohibit decisions based on race, religion, gender—or political affiliation.

Yet, the concern persists: could implicit bias still seep through?

Banks evaluate objective factors like creditworthiness, income, and transaction history. While the system seems neutral on paper, questions about individual cases linger.

How Conservatives Can Protect Their Financial Rights?

Trump’s message resonates with a larger worry about fairness in institutions. For those feeling uneasy about their banking experiences, proactive steps can help:

- Understand Your Protections: U.S. laws safeguard against discrimination in financial services.

- Keep Records: Document any suspicious banking interactions thoroughly.

- Explore Alternatives: Community or credit unions often offer more personalized services with less bureaucracy.

These steps empower individuals to navigate potential challenges confidently.

Final Thoughts

Trump’s remarks highlight the tension between political affiliation and financial equity.

Though evidence of systemic discrimination is unclear, the debate reveals deeper concerns about fairness in corporate systems.

This evolving conversation demands more transparency from financial institutions.

At the same time, it underscores the influence of political narratives in shaping public perception.

Clark is a 26-year-old expert working for consumer protection, Clark has dedicated years to identifying and exposing fraudulent schemes. He is working with NGOs to help people who are victims of scams. In his free time, Todd plays football or goes to a bar.