House Republicans have introduced a bold budget resolution that delivers $4.5 trillion in tax cuts while raising the debt ceiling by $4 trillion.

They aim to extend tax breaks from the Trump era, arguing these measures fuel economic growth.

But within their own ranks, the plan has ignited debate, exposing deep divisions over spending cuts and fiscal responsibility.

The proposal cements tax reductions first implemented during the Trump administration.

Republicans claim these cuts drive business investment, job creation, and overall economic expansion.

However, the resolution also raises the debt ceiling by $4 trillion to avoid a government default—an aspect that has drawn mixed reactions even among conservatives.

To balance these massive tax reductions, House committees must slash $1.5 trillion in spending.

The biggest cuts target Medicaid and other public programs, a move that could reshape the country’s safety net.

Some lawmakers insist deeper reductions are necessary, while others worry about voter backlash over cuts to essential services.

The Republican caucus remains split on how to push this plan forward. Some favor a single sweeping bill covering tax policy, energy initiatives, and border security.

Others argue for a phased approach, addressing each issue separately to increase the likelihood of passage.

Adding to the complexity, House Freedom Caucus Chair Andy Harris has put forth a rival tax proposal.

His plan challenges Speaker Mike Johnson’s efforts to unify Republicans around a single strategy.

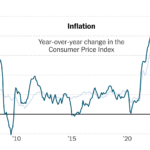

Democrats fiercely oppose the budget, warning it primarily benefits corporations and the wealthy while increasing the deficit.

With the national debt surpassing $34 trillion, critics argue the plan does little to address long-term economic stability.

Instead, they call for targeted tax relief focused on middle-class families rather than across-the-board cuts.

The proposal’s future hinges on tough negotiations in Congress. If Republicans can unite behind a single plan and push it through, it will shape tax and spending policies for years to come.

However, opposition from Democrats and internal GOP conflicts could stall or even derail the effort.

The coming weeks will be decisive as lawmakers battle over the nation’s fiscal direction. Will tax cuts fuel growth, or will the soaring debt spark economic trouble? The debate is just beginning.

Clark is a 26-year-old expert working for consumer protection, Clark has dedicated years to identifying and exposing fraudulent schemes. He is working with NGOs to help people who are victims of scams. In his free time, Todd plays football or goes to a bar.