OANDA offers vast foreign exchange data services, including an exchange rates API, a historical currency converter, and real-time currency data. These tools help businesses and organizations combine accurate and trustworthy FX data into their systems for better financial management.

What is Onada?

OANDA is an online brokerage that provides trading services for forex and CFDs (Contracts for Difference). It offers various financial instruments, including major and minor currency pairs, indices, commodities, metals, and bonds. It is known for its competitive spreads, and fast trade execution, making it a popular choice for traders.

OANDA’s trading platform is accessible via web and mobile apps. It also offers advanced analytical tools powered by TradingView, allowing traders to conduct detailed technical analyses and automate trading strategies using APIs.

Pricing

OANDA offers two main pricing plans Spread-Only Pricing and Commission + Core Spread Pricing for its trading services. Here are the plans in detail.

| Pricing Plan | Description | Example Spreads | Commission |

|---|---|---|---|

| Spread-Only Pricing | Commission is included in the spread, meaning the spread is the only cost you pay. | EUR/USD: from 0.6 pips | None |

| Commission + Core Spread | Lower spreads with a fixed commission per trade. | EUR/USD: from 0.0 pips | $50 per million USD traded |

Pros and Cons of Oanda Broker

OANDA offers over 68 major and minor currency pairs for forex trading. Here are some pros and cons of using it as a trading platform.

Pros

Competitive Spreads: OANDA offers competitive spreads, starting from as low as 0.0 pips on major currency pairs with the commission pricing plan.

Reliable and Fast Execution: It has high-speed trade execution, providing traders get the best available prices.

Comprehensive Tools and Data: It provides advanced vast forex data services like exchange rates API, historical currency converter, and real-time currency data.

Flexible Pricing Plans: It offers spread-only pricing and commission plus core spread pricing, providing different trading preferences and styles.

Educational Resources: It has a wealth of educational materials, including webinars, market analysis, and tutorials, which can be valuable for both beginner and experienced traders.

Cons

Limited Product Range: It has a limited range of tradable assets, focusing mainly on forex and CFDs Compared to other brokers.

Commission Fees: The spread pricing plan offers lower spreads but includes a commission fee, which may not suit all traders.

Inactivity Fees: OANDA charges an inactivity fee if there are no trading activities for a specified period, which can be a disadvantage for occasional traders.

Complex Fee Structure: Some users find the fee structure, particularly with the commission plus core spread pricing complex to use.

Limited Customer Support Options: Some users have reported limited options and slower response times compared to other brokers.

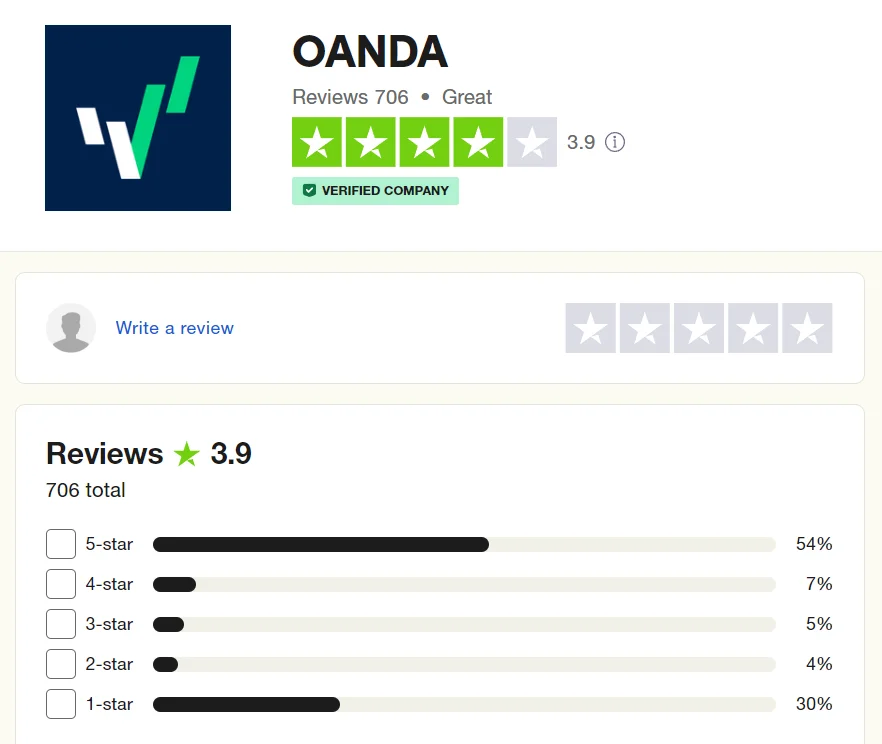

User Review

OANDA has a Trustpilot rating of 4 out of 5 stars. Users appreciate the platform while some users have raised concerns about the complexity of its fee structure.

Very good experience trading in Oanda

Very good experience trading in Oanda. Especially account manager David, he is very caring and helpful all the time. Whenever I met a problem, he will be always there. Thanks David, thanks Oanda.

Source- TrustpilotRead: Java Burn Review

Laura Kemmis is a passionate trendsetter and reviewer, dedicated to researching the latest scams and frauds while sharing her insights with the world. She provides valuable information to keep her audience aware and informed about the latest scams. Additionally, Laura discovers and analyzes trends in fashion, technology, and lifestyle, offering a fresh and honest perspective in her reviews.