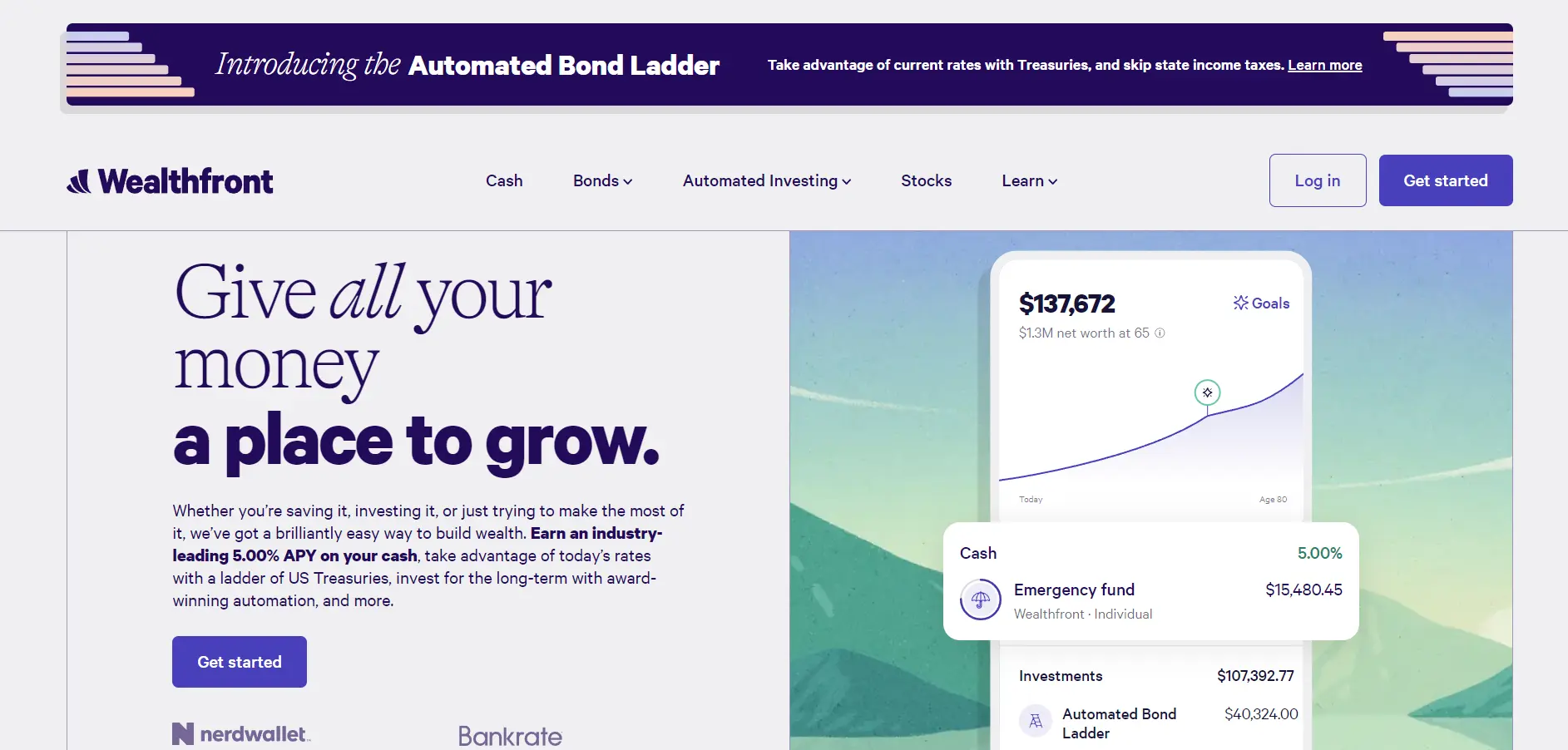

Wealthfront now offers an Automated Bond Ladder, which helps you earn more from current U.S. Treasury rates while reducing your state income taxes.

What Is Wealthfront?

Wealthfront provides With the Automated Bond Ladder, Wealthfront helps you invest in a mix of U.S. Treasuries. These are super safe because they’re backed by the government. By setting up this ladder, Wealthfront aims to give you a stable profit with very little risk. This setup protects your earnings from state and local taxes, so you might keep more of what you earn compared to regular savings accounts or CDs.

Scam Overview

Financial scams come in different forms, such as Ponzi schemes, phishing attacks, pump-and-dump schemes, and advance fee frauds. Ponzi schemes use money from new investors to pay returns to earlier investors and tumble when new investments dry up. Phishing attacks involve scammers tricking people into sharing personal and financial information through fake emails or websites.

In pump-and-dump schemes, fraudsters artificially inflate a stock’s price and then sell their shares, leaving other investors with worthless stock. Advance fee frauds promise significant returns or loans in exchange for an upfront fee, which victims never get back.

Is It Legit Or Scam?

While Wealthfront has its strengths, some users on Trustpilot have voiced concerns. Here are a few red flags to consider:

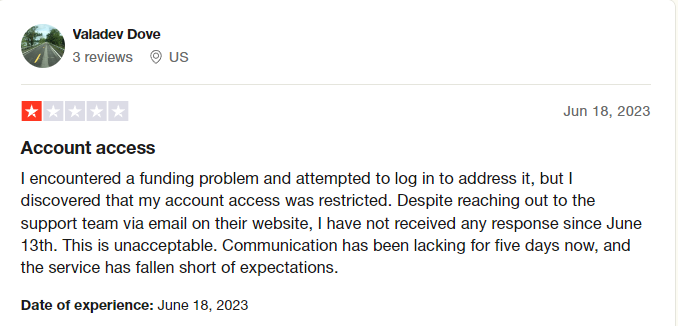

1. Problems with Account Access

Some users faced difficulties accessing their accounts and received poor responses from customer support. This lack of quick help can be disappointing.

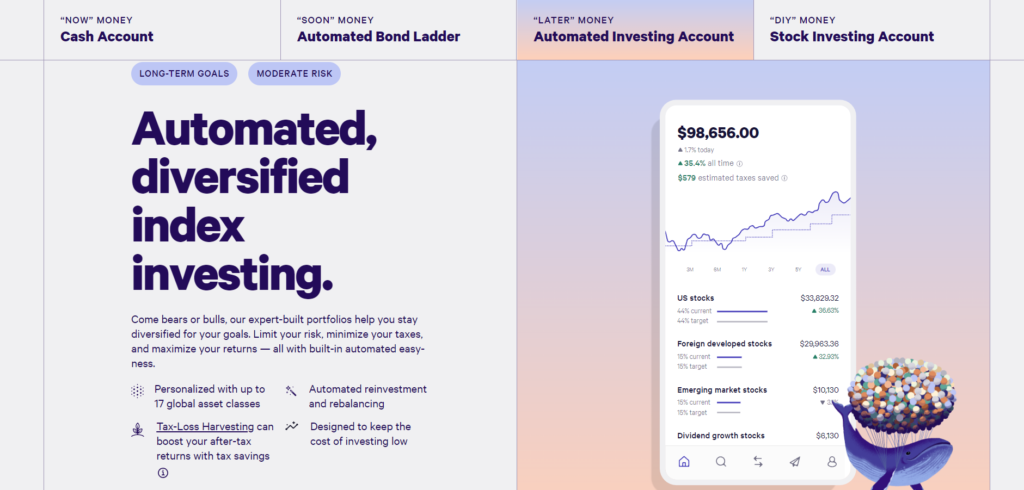

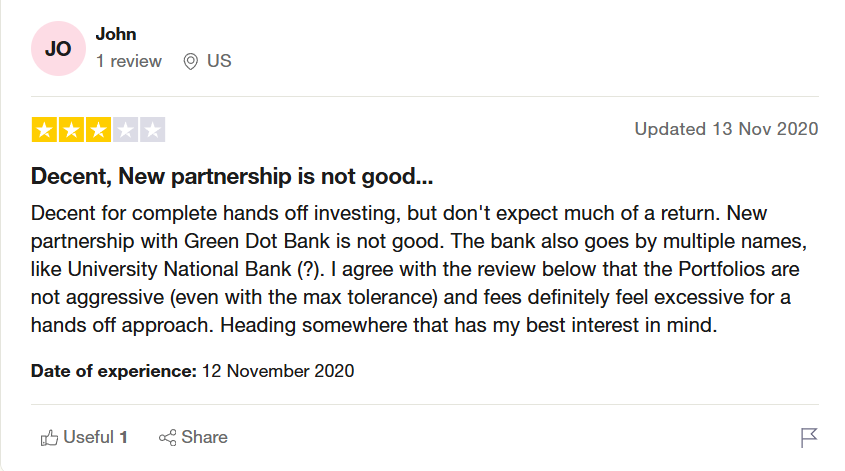

2. Portfolio Conservatism

Despite offering automated investing, Wealthfront’s investment portfolios may not be aggressive enough for some investors, even for those with a high-risk tolerance.

3. Lack of Transparency

The company isn’t clear about its fees, investment strategies, or background, which is concerning. It feels like a scam because trustworthy companies always share information about their fees and strategies with people.

4. Partnership with Green Dot Bank

Wealthfront’s collaboration with Green Dot Bank has faced complaints. Green Dot Bank holds a low 3-star rating on Trustpilot, which has made some users uneasy about this partnership.

How To Spot These Scam?

To protect yourself from scams, especially in the financial sector, consider the following tips:

- Verify Registration: Use the SEC’s Investment Adviser Public Disclosure (IAPD) website or FINRA’s BrokerCheck to confirm the company’s registration and background.

- Do Your Research: See the customer reviews, expert opinions, and news articles about the company to get a complete picture.

- Ask Questions: Don’t be afraid to ask about their services, fees, and regulatory status. Honest companies will provide clear answers.

- Be Wary of Big Promises: Be careful of services that guarantee high returns with no risk. If it seems good, it probably is.

- Look for Transparency: A trustworthy company will offer clear and detailed information about its services, fees, and investment strategies.

Read: American Express Blue Cash Everyday Review

Erika is a Computer Science student with a passion for reading and digital exploration. She loves to read personal growth books and spends her free time navigating various websites, improving her technological skills and understanding of web platforms. Erika is particularly interested in cybersecurity and stays updated on news related to scams and fraud. Her curiosity and dedication push her to pursue a career where she can innovate and improve digital safety and user experiences.