Sallie Mae offers different resources to help students pay for school, such as finding scholarships, financial information, and college planning. However, many people ask if Sallie Mae is trustworthy. Here we will review Sallie Mae and tell you whether it is legit or a scam.

What Is Sallie Mae?

Sallie Mae, also known as SLM Corporation, is a major company that provides private student loans, banking services, and savings programs. It started as a government-sponsored organization in 1972 to help with federal student loans but became a private company in 2004.

Sallie Mae is well-known for offering different types of loans to help students and their families pay for college, including loans for undergraduates, career training, and parents.

Read: Stateitude.com Review: Legit Or Scam?

Is Sallie Mae Legit?

There are several Red Flags associated with Sallie Mae that suggest it might not be a trustworthy website. Here are some points that can be considered.

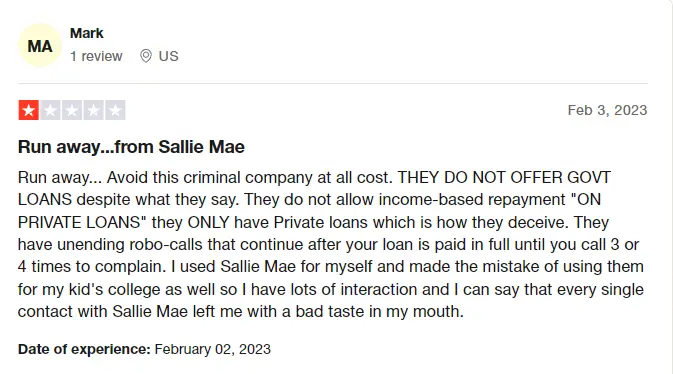

False Claims About Loan Types

Users say that Sallie Mae only offers private loans, even though it might seem like they provide government loans. This can be confusing, mainly for people looking for national loan benefits like income-based repayment plans, which aren’t available with private loans.

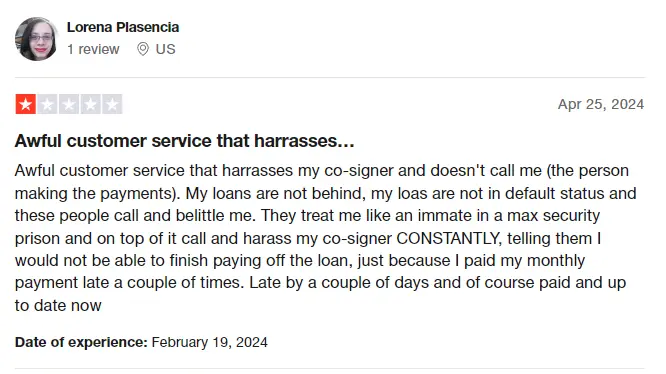

Aggressive Communication

Many users have reported that Sallie Mae bombards them with constant and unending Robo-calls, even after they’ve fully paid off their loans. These annoying calls often only stop after they’ve made multiple complaints.

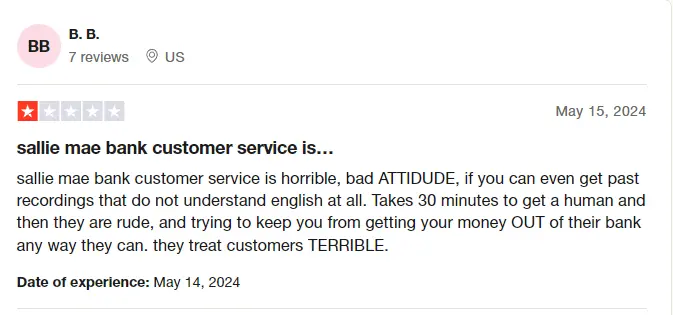

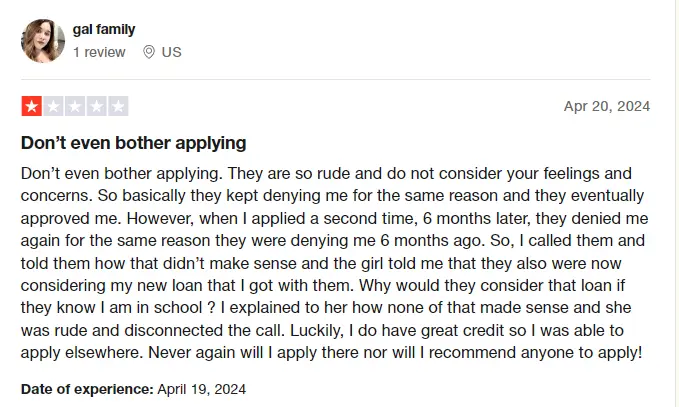

Unresponsive Service

Customers say the service is rude, unresponsive, and hard to deal with. They struggle to reach a real person, and when they do, the help they get is often unhelpful and dismissive.

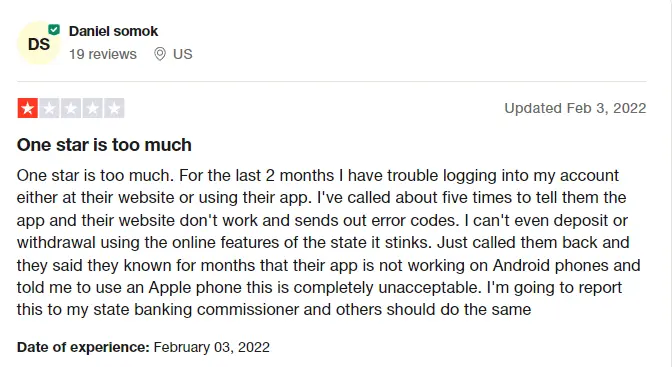

Technical Issues

Many users experience problems with the Sallie Mae website and mobile app. They often can’t log in, make deposits, or withdraw funds because of technical errors. Customer service has acknowledged these issues and suggested switching to Apple devices, which many users find unacceptable.

Debt Handling Issue

Sallie Mae has been charged with selling debts to multiple collectors, leading to constant harassment calls and increased debt amounts. Users say their debts have grown significantly over the years because of this, with some debts rising from $8,000 to $54,000.

Credit Score Impact

Many co-signers on Sallie Mae loans see their credit scores drop significantly, even if they make on-time payments. This can be quite disappointing and harmful for those who have excellent credit.

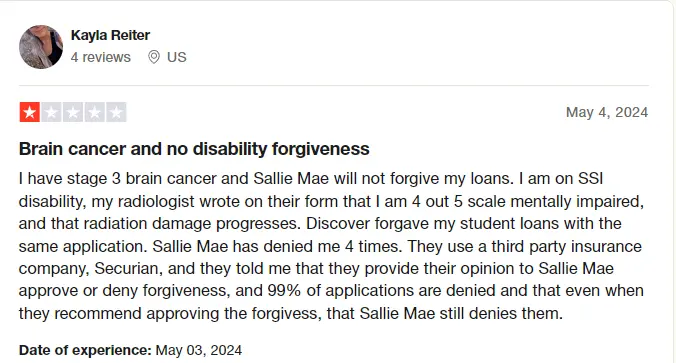

Loan Forgiveness Refusal

Users with serious health issues, like stage 3 brain cancer, have reported that Sallie Mae refuses to forgive their loans, even when other lenders have approved similar requests. The decisions are made by a third-party insurance company, which results in rejections, increasing stress and financial responsibilities for borrowers.

Conclusion

Sallie Mae is a company that offers private student loans and other resources to help pay for college, but many people have had problems with it.

These include Complaints of misleading information about the types of loans, persistent phone calls, poor customer service, website issues, mishandling debts, hurting credit scores, and denying loan forgiveness for serious health issues. Because of these problems, students should be careful and consider these issues before choosing Sallie Mae for their loans.

Read: Illinois Tollway Text Scam: All You Need To You

Erika is a Computer Science student with a passion for reading and digital exploration. She loves to read personal growth books and spends her free time navigating various websites, improving her technological skills and understanding of web platforms. Erika is particularly interested in cybersecurity and stays updated on news related to scams and fraud. Her curiosity and dedication push her to pursue a career where she can innovate and improve digital safety and user experiences.