The ANZ Credit Cards Class Action has recently attracted attention, highlighting important financial practices and consumer rights issues.

This class action was started by Phi Finney McDonald, a law firm, and focuses on serious claims against the Australia and New Zealand Banking Group (ANZ) relating to unfair interest charges on credit cards.

In this post, we will explore the background of the class action, what the settlement means, and how it affects the banking industry and customers.

What Is Class Action?

The class action filed in 2021 targets interest charges on ANZ personal credit cards from July 1, 2010, to January 1, 2019.

The main charge is that ANZ charged interest to customers who had paid off their credit card balances within the ‘interest-free‘ period advertised by the bank.

The claimants argue that this practice was misleading and unfair because it allowed ANZ to cancel the interest-free periods.

Many customers expected their credit card balances to be interest-free based on the bank’s promotions and card terms.

However, ANZ allegedly charged interest during these supposed interest-free periods, which contradicted, what customers were shown to believe. This caused financial inconvenience for those affected.

Settlement Details of ANZ With Class Action

In March 2024, ANZ agreed to pay $57.5 million to settle the class action. It’s important to know this settlement does not mean ANZ admits any wrongdoing.

The purpose of the settlement is to compensate customers who were charged unfair interest, and it still needs court approval.

This agreement resolves the issues for the affected customers without dragging the case through a lengthy court battle.

The settlement will provide compensation to affected customers, but distributing this money involves several administrative steps. Customers involved in the class action should check official updates from the court or their legal representatives to stay informed about how and when they will receive their compensation.

Is Anz Class Action Scam?

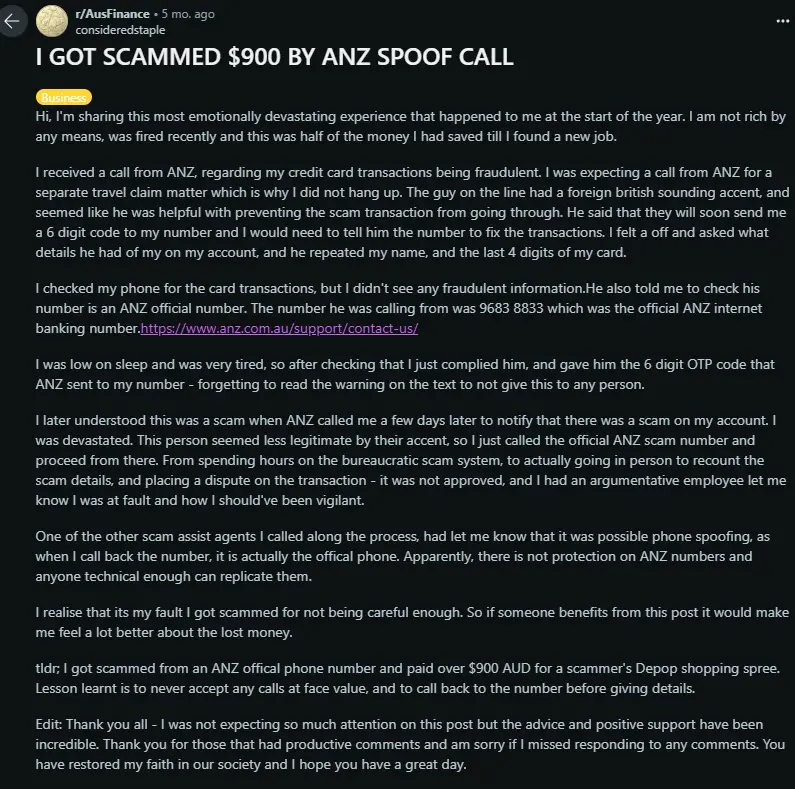

Some customers have expressed concerns about whether the ANZ Credit Cards Class Action is legitimate. To clear things up, the class action is genuine but many users got suspicious calls and messages.

In this situation the scammer asked for a 6-digit code and the fact that they used ANZ’s official phone number. Even though the number seemed legitimate. The real ANZ team never asks for sensitive information like OTPs over the phone.

The notices you have received, including text messages and emails, have been approved by the Federal Court of Australia but scammers use this as a thing to trick people.

These communications are a normal part of the legal process to keep affected individuals informed about their rights and the status of the case.

If you have received a notice or been contacted about your involvement in the class action, you can be confident that your claims are managed through official legal channels. It is important to verify that it was from genuine authorities.

The involvement of the Federal Court and the reputable law firm Phi Finney McDonald confirms that the class action is valid.

The settlement provides compensation to affected customers, but distributing this money involves several steps.

Conclusion

The ANZ Credit Cards Class Action highlights the need for transparency and fairness in finance. The settlement compensates affected customers for unfair interest charges. This case also reminds consumers and banks to maintain clear and honest practices.

Customers should stay informed about their rights and seek legal advice if they feel they’ve been treated unfairly. This class action not only resolves past issues but also sets a standard for future consumer protection.