In today’s age, scams are becoming more advanced and overall, targeting people in various ways. One such scam is the Sunrise Debt Collector Scam. This scheme takes advantage of people’s fear of debt and financial instability to make money.

In this post, we will review the Sunrise debt collector scam, how it works, signs of Sunrise debt collector scam, and what to do if you fall for this scam.

Sent by you:

What is Sunrise Debt Collector Scam?

The Sunrise Debt Collector scam is a trick used by fraudsters pretending to be real debt collectors. Their goal is to steal personal information from victims, which they can use for identity theft or other fraud.

These scammers use urgent and threatening language to threaten victims into paying without verifying if the debt is real. The scammers demand payment through strange methods.

Sunrise Debt Collector Reviews

Sunrise Credit Services, a debt collection agency established in 1974, is part of the Sunrise Family of Companies. Consumer satisfaction is low due to complaints about aggressive tactics and poor customer service. It’s essential to verify any debts and be cautious with personal information when dealing with them.

Sunrise Debt Collector Scam Text Message

A Sunrise Debt Collector Scam text message includes an urgent tone, claiming you owe a debt and must pay immediately to avoid legal consequences.

It uses threats and intimidation to pressure you into quick action and includes a payment link to extract your personal details.

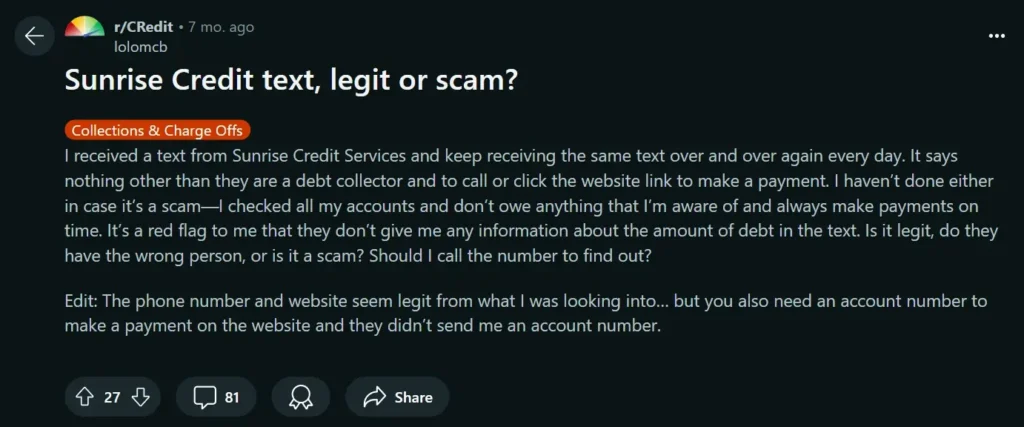

Sunrise Debt Collector Reddit

There are multiple discussions about the Sunrise Debt Collector scam on Reddit, where users have shared a broad range of personal experiences and understandings.

Sunrise Debt Collector Scam Phone Number

If you need to contact Sunrise Credit Services about debt-related issues, you can call them at (800) 208-8565.

How Sunrise Debt Collector Scam Works?

The Sunrise Debt Collector Scam starts with a phone call, email, or letter from someone claiming to represent a debt collection agency named “Sunrise Debt Collection Agency.”

The scammers use official-sounding language and even provide some personal information about the victim, such as their address or partial social security number, to appear legitimate.

They claim that the victim owes a significant amount of money and must pay it immediately to avoid severe effects like legal action, wage garnishment, or damage to their credit score.

Once they have the victim’s attention, the scammers use high-pressure tactics to create a sense of urgency and fear.

The goal is to make the victim act quickly without verifying the legitimacy of the debt. Once the payment is made, the scammers disappear, and the victim realizes they’ve been defrauded.

What to do if you fall for Sunrise Debt Collector Scam?

If you realize you have fallen for the Sunrise Debt Collector scam or similar scam like this, here are some steps you should take.

Stop Communication: Stop all communication with the scammers. Do not respond to any more texts, emails, or phone calls from them.

Verify the Debt: Contact the alleged debt collector directly using the official contact information found on their legitimate website or through other verified sources. Confirm if the debt mentioned is real.

Tell Your Financial Institutions: Inform your bank and credit card companies about the scam. If you provide any financial information, they can help monitor for unauthorized transactions and take preventive measures.

Reporting the Scam: File a complaint with the FTC at reportfraud.ftc.gov. The FTC collects information about scams and can help prevent others from falling victim.

Consider a Credit Freeze: If you believe your identity has been compromised, consider freezing your credit. This prevents new credit accounts from being opened in your name without your permission.

FAQs

Sunrise Credit Services has been a prominent name in accounts receivable management since 1974, offering complete debt collection services and related solutions to a wide range of client-partners.

To verify if a debt collection agency is legitimate, check its credentials and licensing with your state’s regulatory agency. Contact the original creditor using official contact information to confirm the debt, and confirm the agency provides written documentation before making any payments.

Laura Kemmis is a passionate trendsetter and reviewer, dedicated to researching the latest scams and frauds while sharing her insights with the world. She provides valuable information to keep her audience aware and informed about the latest scams. Additionally, Laura discovers and analyzes trends in fashion, technology, and lifestyle, offering a fresh and honest perspective in her reviews.