Consumer confidence is slipping fast, and the numbers prove it. The University of Michigan’s latest report shows a sharp 5% decline in sentiment, dropping from 71.1 in January to 67.8 in February.

This decline signals a growing unease among Americans about their financial future.

Concerns over inflation, economic stability, and shifting government policies are making people second-guess their spending and investment decisions.

Inflation fears are at the forefront of this growing uncertainty. The report reveals that Americans now expect inflation to hit 4.3% this year—a full percentage point higher than last month’s forecast.

Prices for essentials like food, gas, and housing continue to climb, forcing many to rethink their financial plans.

As the cost of living surges, households are tightening their budgets and cutting back on discretionary spending.

Government policies are also fueling consumer concerns. Data from Morning Consult shows that confidence is fading amid uncertainty over executive orders and potential new tariffs.

Many fear that abrupt policy changes could lead to job losses, higher costs, and economic instability.

As debates over trade policies and fiscal decisions continue, businesses and consumers alike are left wondering how these shifts will impact their financial well-being.

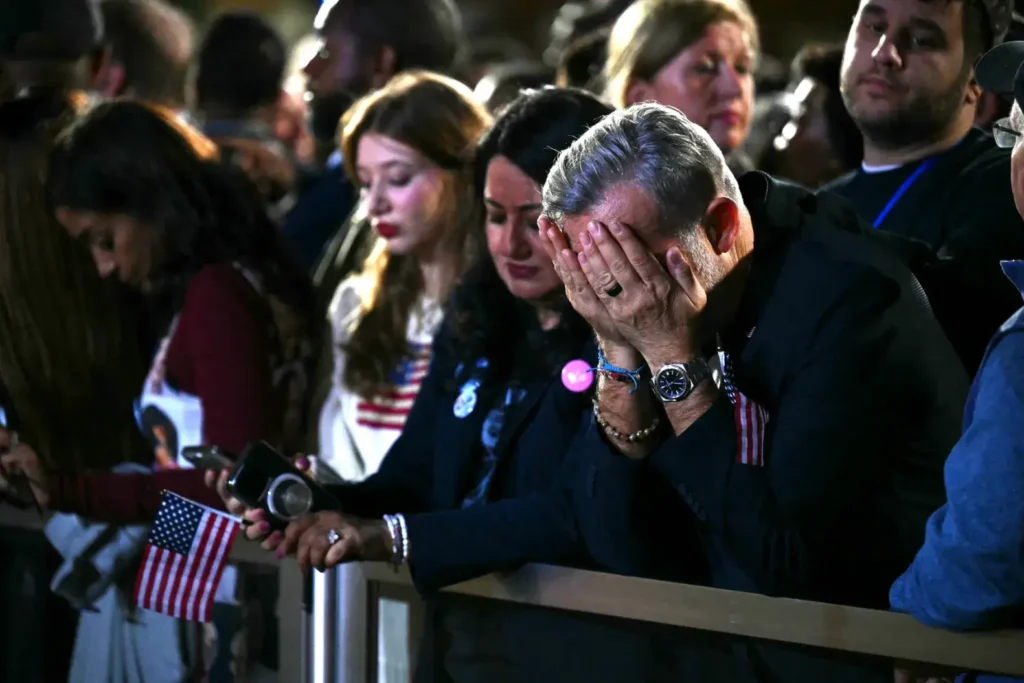

Trump Supporters Are Feeling the Pressure

Economic uncertainty is rattling even the most steadfast supporters of former President Donald Trump.

Paul Bisson, a 58-year-old flight safety consultant and small business owner, voiced his concerns to The Wall Street Journal.

“I don’t like the turbulence,” Bisson admitted. “I don’t like the chaos in the market. That’s not what we signed up for.”

Planning for retirement, Bisson now worries that continued instability could erode his savings and disrupt his long-term financial goals.

Market volatility is driving investors to seek safer options. Geneticist Nicholas Schuch, 38, is taking drastic steps to protect his wealth.

Concerned about the future of U.S. monetary policy, he is considering moving half of his life savings into Swiss Francs.

“I just expect things will be chaotic, and that is what life is now,” Schuch explained.

His sentiment echoes the growing frustration among investors who are struggling to navigate an unpredictable market.

How to Protect Your Finances Amid Economic Uncertainty

With consumer confidence on the decline, taking proactive steps can help you stay financially secure. Here’s what you can do:

- Keep an Eye on Inflation: Monitor price trends and adjust your budget to keep up with rising costs.

- Diversify Your Investments: Explore safer options to cushion your portfolio against market instability.

- Build an Emergency Fund: Uncertainty makes financial reserves more crucial than ever.

- Stay Informed: Keeping up with policy changes and economic forecasts can help you make smarter financial decisions.

The drop in consumer confidence highlights deep-seated concerns about inflation, government policies, and economic stability.

While uncertainty looms, being proactive can help you navigate these challenges.

Whether you’re a consumer, investor, or business owner, now is the time to reassess your financial strategies.

Planning ahead and staying informed will put you in a stronger position to weather economic shifts and safeguard your future.