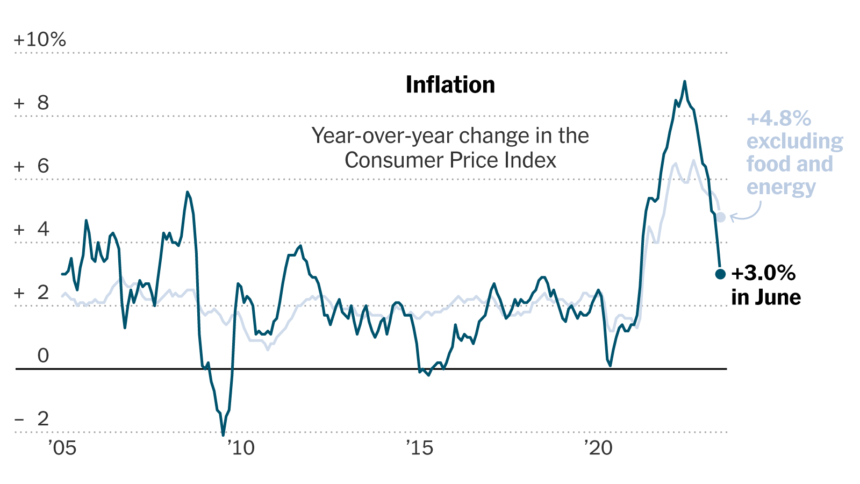

Inflation in the U.S. has surged to 3% in January 2025, the highest level since mid-2024. This unexpected jump is putting pressure on household budgets, shaking up financial markets, and forcing the Federal Reserve to reconsider its plans.

For months, economists had predicted a cooling inflation rate, but rising prices in food, energy, and services tell a different story.

Many Americans are now asking: Why are prices still rising? Will interest rates remain high? And how will this affect my daily expenses? Let’s break it all down.

What’s Driving Inflation Higher?

The latest data shows inflation isn’t slowing as much as expected. Several key factors have contributed to this rise.

Egg prices, for example, skyrocketed by 15.2% in just one month due to a severe outbreak of avian flu. Consumers are feeling the pinch at grocery stores as essential items like dairy, vegetables, and meats also see price hikes.

Energy costs are another major culprit—higher heating bills, rising gasoline prices, and increasing electricity costs are eating into disposable income.

Even after removing volatile food and energy costs, core inflation rose by 0.4% in January, bringing the annual core rate to 3.3%.

This suggests that inflation isn’t just a temporary spike but a persistent issue affecting a wide range of goods and services.

How This Impacts Your Daily Life

Higher inflation means your paycheck won’t stretch as far. Here’s what to expect in the coming months:

- Grocery Bills Keep Rising: Staples like eggs, milk, and bread cost more, making meal planning a challenge for families.

- Housing Costs Stay High: Rent, home insurance, and mortgage rates remain elevated, forcing many to rethink buying or renting decisions.

- Credit Cards and Loans Stay Costly: The Federal Reserve might delay cutting interest rates, keeping credit card and loan payments expensive.

Stock Market Takes a Hit, Bitcoin Surges

Wall Street reacted swiftly to the inflation news, with major stock indexes experiencing a sharp drop. The Dow Jones fell over 395 points, while the S&P 500 and Nasdaq also declined.

Investors are growing increasingly concerned that the Federal Reserve may delay its expected interest rate cuts, keeping borrowing costs high for longer than anticipated.

At the same time, Bitcoin surged to nearly $95,000, with investors looking for alternative assets to hedge against inflation.

The cryptocurrency market, which often reacts sharply to economic uncertainty, saw a wave of buying activity as concerns about the strength of the U.S. dollar resurfaced.

Will the Fed Cut Interest Rates Soon?

The Federal Reserve now faces a difficult balancing act. Cutting rates too soon could lead to another wave of inflation while keeping them high for too long could slow down economic growth.

Fed officials have repeatedly emphasized that rate cuts would depend on inflation cooling further, but January’s report complicates the timeline.

Adding another layer of uncertainty, President Trump’s proposed tariffs on foreign goods could push inflation even higher.

If enacted, these trade policies may drive up prices on imports, affecting everything from consumer electronics to automobiles.

How Can You Stay Ahead?

Inflation may be beyond your control, but managing your finances wisely can help you stay ahead.

Trimming non-essential spending, seeking out better deals on everyday purchases, and prioritizing savings can make a significant difference.

Those with debt should consider locking in fixed-rate loans before any further rate increases.

The coming months will be crucial in determining whether inflation continues its upward trend or finally cools down. In the meantime, staying informed and making strategic financial choices will be key.