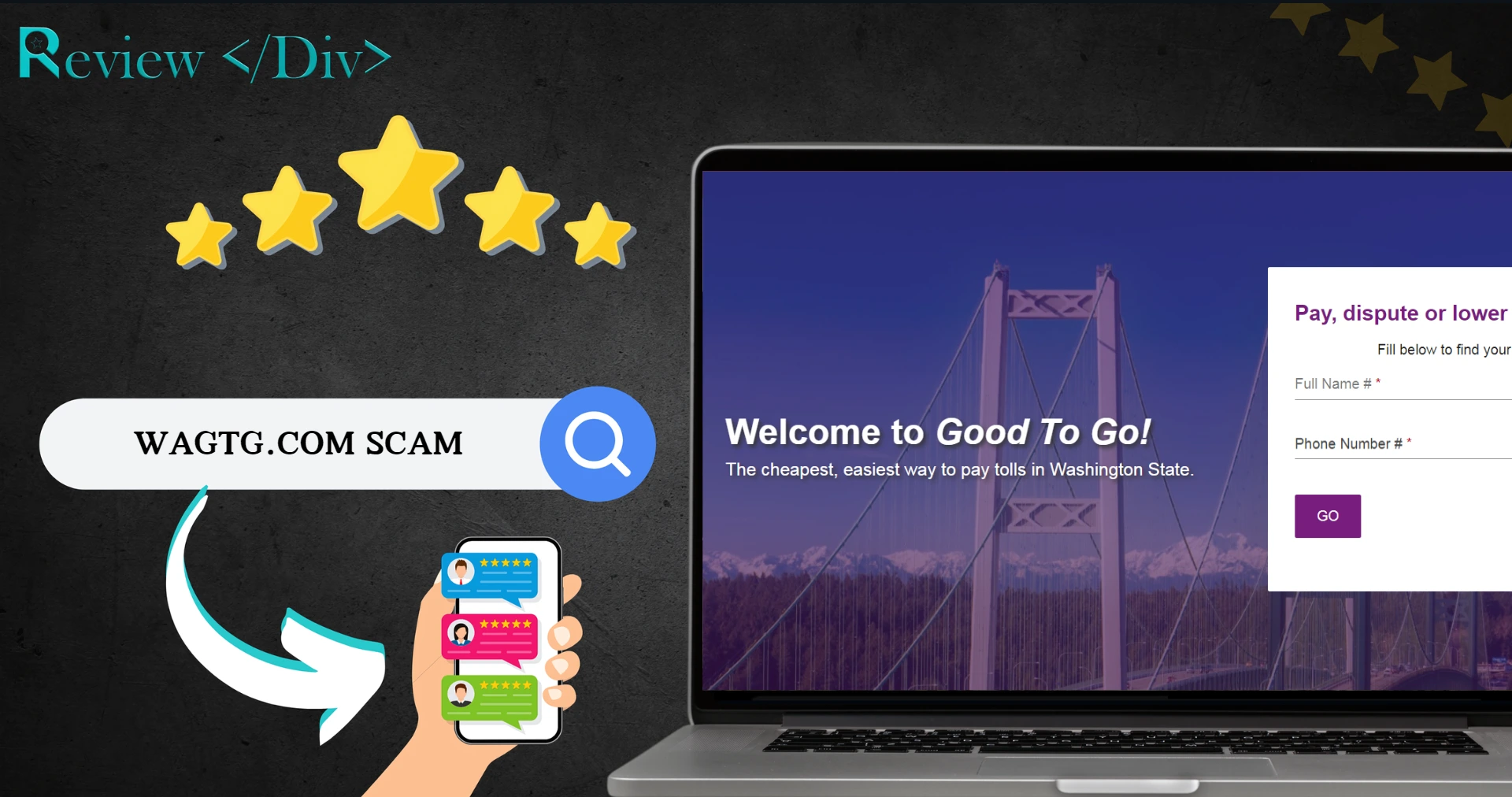

Scam websites have become more advanced recently, and Wagtg.com is one of them. It seems to be connected to the Washington State Department of Transportation’s (WSDOT) “Good To Go!” toll system.

However, before sharing any sensitive information, it’s important to check if the site is legitimate.

In this article, we will review the Wagtg.com Scam, how this scam works, and what to do if you fall for this scam.

What Is Wagtg.com?

Wagtg.com looks like a website connected to Washington State’s “Good To Go!” toll system. It helps users manage toll payments in Washington. On the site, you can pay toll bills, dispute charges, or lower penalties.

They claim that you can also activate toll passes, manage your account, and learn how to set up accounts for rental cars or avoid extra fees. Overall, it provides various services for drivers using toll roads in Washington.

How Does Wagtg.com Scam Work?

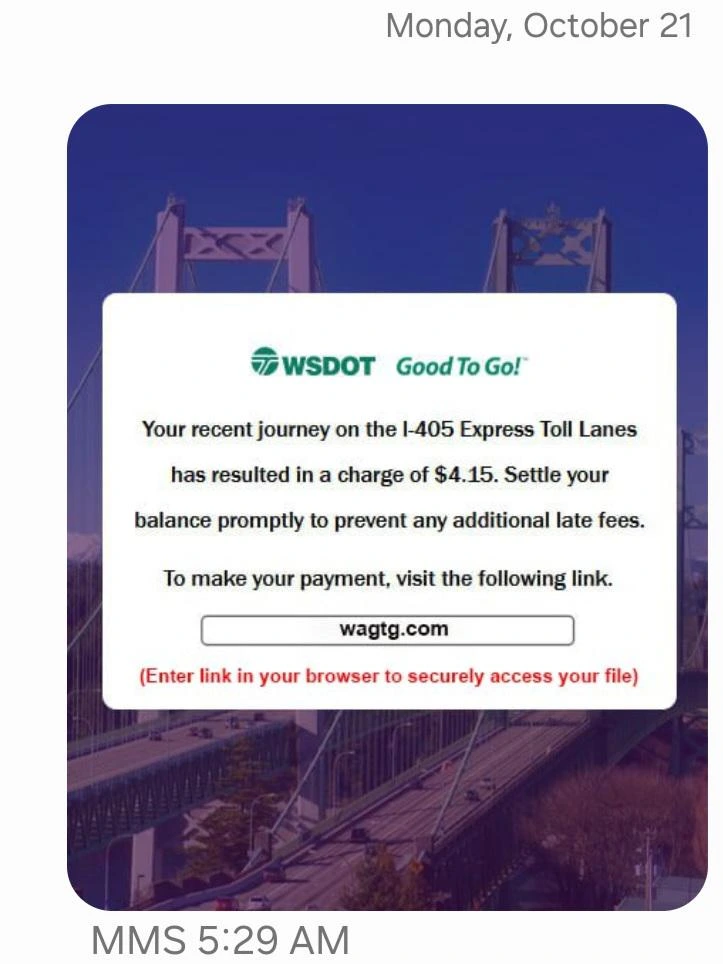

The Wagtg.com scam works by tricking people with fake messages, usually through SMS or email, claiming they owe unpaid toll fees. These messages create panic by threatening legal action or extra charges if they don’t pay immediately.

The message includes a link that looks like a real toll payment site, but it’s fake. Once victims click on the link, they’re asked to provide personal and financial details like their credit card information.

Scammers collect this data for identity theft or to make unauthorized transactions. Many victims only realize they’ve been scammed when they see suspicious charges or their information is misused.

What To Do If You Fall For Wagtg.com Scam?

If you’ve interacted with Wagtg.com or shared any personal information, act fast to reduce the damage. Follow these steps.

1. Stop Giving Information

If you realize it’s a scam after entering your details, stop sharing any more information right away. Avoid replying to any further messages or emails from the scammers.

2. Change Your Passwords

If you used the same password or email for other accounts, change them immediately. Also, enable two-factor authentication (2FA) wherever you can for extra security.

3. Check Your Financial Accounts

Monitor your bank and credit card statements closely for any suspicious transactions. If you see anything unusual, report it to your bank or credit card company as soon as possible. They can help freeze your account and stop more unauthorized charges.

4. Report the Scam

Notify local authorities, such as the police or a consumer protection agency. In the U.S., you can report the scam to the Federal Trade Commission (FTC) or the Internet Crime Complaint Center (IC3). Reporting helps authorities track and shut down fraudulent sites.

5. Learn About Phishing Scams

Educate yourself about phishing scams to avoid falling for them again. Be careful with unsolicited messages asking for personal or financial information, especially if they create urgency. Always verify these requests with the official organization using trusted contact methods.

6. Consider Identity Protection Services

If you think your personal information is at risk, consider using an identity theft protection service. These services can watch for signs of misuse and assist you if identity theft occurs.

Erika is a Computer Science student with a passion for reading and digital exploration. She loves to read personal growth books and spends her free time navigating various websites, improving her technological skills and understanding of web platforms. Erika is particularly interested in cybersecurity and stays updated on news related to scams and fraud. Her curiosity and dedication push her to pursue a career where she can innovate and improve digital safety and user experiences.