Imagine walking into a home you’ve dreamed of for years, only to realize that its price tag feels like a cruel joke. That’s the reality for millions of Canadians today, as housing prices soar beyond reach.

But what’s driving this crisis? The answer lies in a tangled web of economic policies, zoning laws, and cultural mindsets that have created the perfect storm.

Too Many People, Not Enough Homes

Canada’s population is growing rapidly, thanks to immigration and natural population increases. In 2022 alone, Canada welcomed over 400,000 immigrants—the highest number in decades.

But here’s the catch: while the population has surged, the construction of new homes has lagged behind.

Building homes isn’t just about putting bricks together. In cities like Toronto and Vancouver, restrictive zoning laws and bureaucratic red tape make it nearly impossible to keep up with demand.

For example, a single-family home in Ontario can cost over $500,000 just to build due to expensive permits and lengthy approval processes.

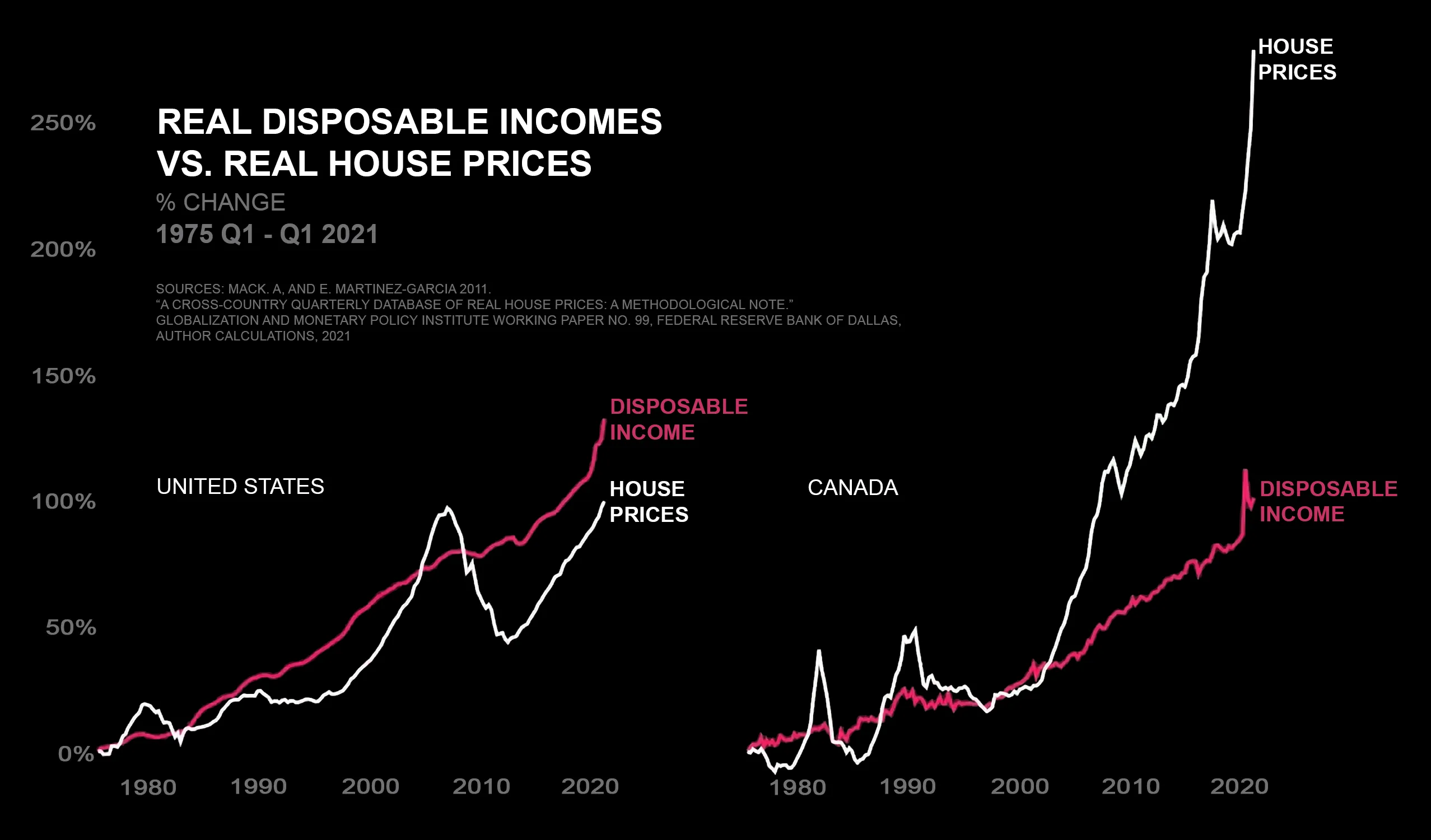

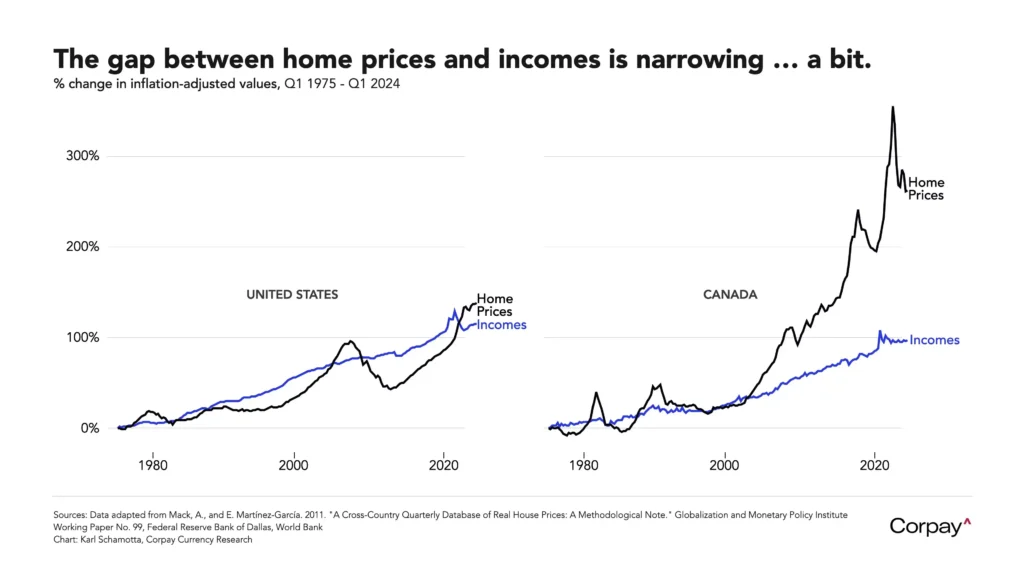

When supply can’t match demand, prices rise. It’s basic economics.

The Lending Trap: Easy Money, Big Debt

Another culprit is Canada’s lenient lending policies. For years, banks have been issuing loans at record-low interest rates, making it easier for people to buy homes. Sounds great, right? Not quite.

The availability of easy money has led to skyrocketing household debt—now the highest in the G7 countries. What’s worse, government agencies like the Canada Mortgage and Housing Corporation (CMHC) back these loans.

This creates a safety net for banks but leaves homeowners vulnerable. If the housing bubble bursts, taxpayers will bear the brunt of the fallout.

The Foreign Investment Dilemma

Foreign investors see Canada’s real estate market as a goldmine. Wealthy individuals from countries like China park their money in Canadian homes to safeguard their wealth, often leaving these properties vacant.

This drives up prices and reduces the number of available homes for actual residents. But here’s the kicker: foreign investment isn’t the main villain.

Toronto’s vacancy rates have remained stable for over a decade, suggesting that other factors, like domestic speculation, play a bigger role.

The Canadian Mindset: Homes as Investments

In Canada, owning a home is more than a dream—it’s a status symbol and a financial strategy.

Many Canadians see real estate not as a place to live but as a way to build wealth.

This cultural mindset fuels bidding wars and drives up prices. When people treat homes like stocks, affordability takes a backseat.

The Municipal Money Crunch

Local governments in Canada depend heavily on property taxes. If property values drop, municipal budgets collapse, affecting services like schools and public transit.

To avoid this, cities often prioritize vanity projects—think $100 million libraries—over affordable housing.

This vicious cycle ensures that property values stay high, even at the expense of the average Canadian family.

Is There a Way Out?

Fixing Canada’s housing crisis isn’t impossible, but it requires bold action:

- Build More Homes: Streamline zoning laws and cut red tape to allow for faster construction.

- Tax Foreign Investors: Implement stricter regulations to curb speculative buying.

- Rethink Lending Policies: Tighten loan approvals to reduce household debt.

- Promote Affordability: Encourage housing strategies that prioritize people over profit.

A Story of Hard Choices

Take Lisa, a 35-year-old teacher in Toronto. She’s been saving for a down payment for years but finds herself priced out of even modest homes. Lisa represents countless Canadians caught in this housing nightmare. Her story is a stark reminder that the dream of homeownership is slipping away for many.

Canada’s housing market reflects more than numbers; it tells the story of a nation struggling to balance growth, opportunity, and fairness. The question is, how much longer can we afford to ignore the signs?

The answer isn’t just about building houses—it’s about building hope.