When Donald Trump introduced his revamped economic agenda, branded as Maganomics, it reignited a heated debate about America’s financial future. Trump claims that if he returns to the White House in 2025, his policies will reignite American prosperity by cutting regulations, slashing taxes, and reshaping trade.

But many economists are sounding the alarm, warning that this plan could have unintended consequences for economic growth and everyday Americans.

Imagine walking into your local grocery store in early 2025. You head to the checkout and notice something unsettling—prices have jumped again. Milk, bread, and even fresh produce cost more than they did last month. As you swipe your card, you wonder why your paycheck isn’t stretching as far as it used to.

It’s not just the grocery bill. Local businesses are closing, construction sites seem abandoned, and your neighbor—who runs a small farm—complains that he can’t find workers to keep things running.

This scenario might sound like a bad dream, but some economists believe it could become a reality if U.S. President-elect Donald Trump’s “Maganomics” policies come to life. Trump is promising a booming economy if he returns to office in 2025, but experts warn that the plan could backfire.

What Is Maganomics?

Maganomics isn’t just a catchy name — it’s Trump’s economic vision. The plan builds on policies from his first term but takes things to a new level. Trump promises to bring back American jobs by cutting regulations, imposing tariffs, and deporting undocumented immigrants.

Here’s a snapshot of what Maganomics includes:

- Mass deportation of undocumented immigrants

- Tariffs on imported goods to make U.S. products more competitive

- Elimination of environmental and financial regulations

- Tax cuts primarily benefiting wealthy individuals and corporations

On the surface, it sounds like a plan to put America first and bring back prosperity. But scratch beneath that surface, and you’ll find concerns that have economists worried about how it might play out in the real world.

Why Economists Are Worried

Economists are expressing significant concerns about the potential negative impacts of Donald Trump’s proposed “Maganomics” policies on economic growth.

Mass Deportation Could Lead to Labor Shortages

Imagine waking up one day to find that millions of workers have vanished. That’s essentially what Trump’s proposed mass deportation plan could do to industries that heavily rely on immigrant labor, like farming, construction, and hospitality.

Think about your local farm. Without workers to pick crops, food supply chains slow down, and prices spike. Construction projects are delayed, making homes more expensive. Restaurants and hotels might struggle to find staff, impacting tourism and local economies.

The ripple effect? A labor shortage that could shrink the U.S. economy.

Tariffs Could Make Everyday Items More Expensive

Remember when Trump imposed tariffs during his first term? Prices on electronics, clothing, and even basic household goods went up. That’s because businesses often pass the added costs of tariffs onto consumers.

Now, imagine even harsher tariffs on imported goods.

Your favorite imported coffee? More expensive. Electronics made with foreign parts? Higher prices. Even items made in the U.S. could see price hikes, thanks to rising supply costs.

This could fuel inflation—the very thing Americans have been trying to escape after years of rising living costs.

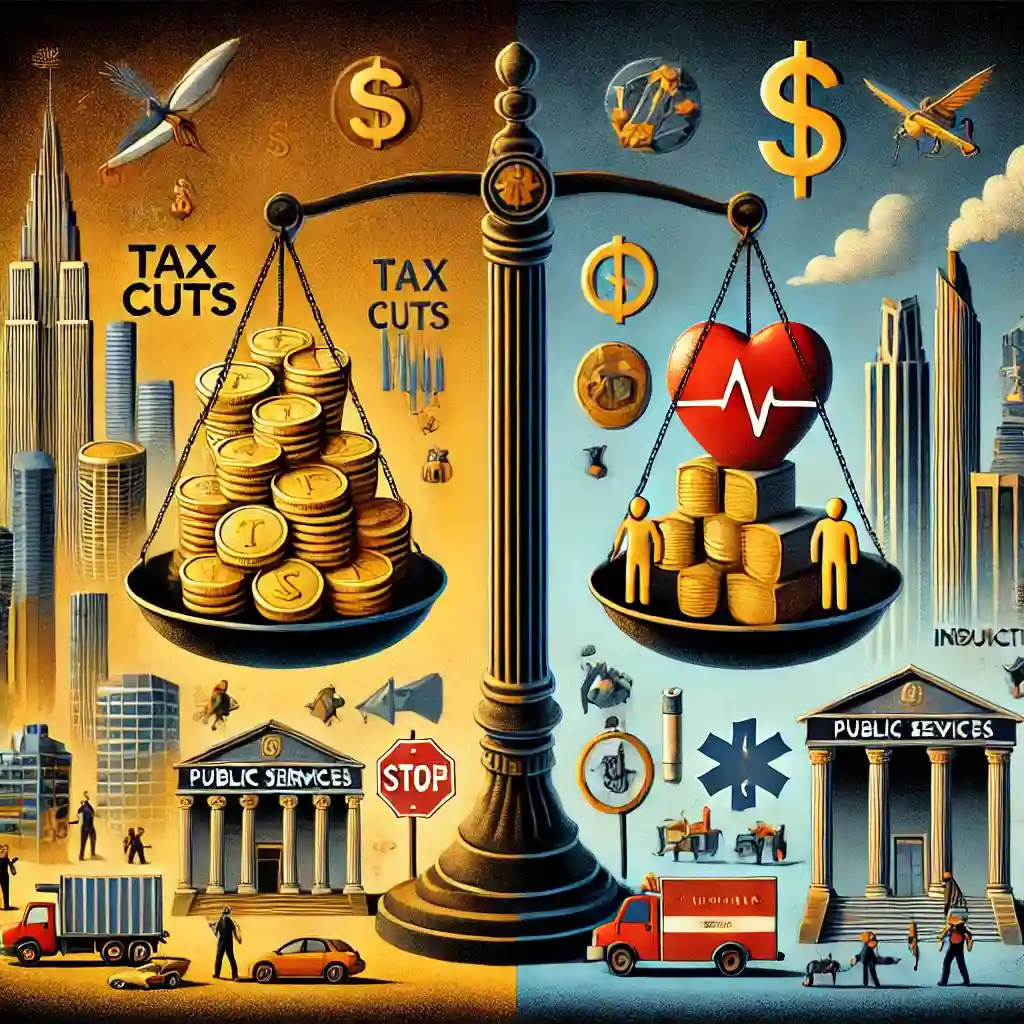

Tax Cuts Could Benefit the Wealthy — But at a Cost

Trump’s plan includes tax cuts for wealthy individuals and corporations. While that might sound like a good move for businesses, it raises a crucial question:

Who will pay for public services like schools, infrastructure, and healthcare?

When the government collects less revenue from taxes, it borrows money to cover its expenses. Over time, this borrowing increases the national deficit and can lead to cuts in essential public programs that millions of Americans depend on.

Imagine a scenario where your child’s school struggles to fund extracurricular activities or your local hospital has fewer resources. These aren’t just numbers on a government spreadsheet—they’re real-life consequences.

Ignoring Environmental Risks Could Hurt Long-Term Growth

Environmental regulations may seem like a burden for businesses, but ignoring climate-related risks can cost billions in the long run.

Think about it:

- Hurricanes destroy infrastructure.

- Wildfires wipe out entire communities.

- Floods disrupt supply chains.

If businesses face repeated climate disasters without regulatory safeguards, the result could be economic instability that affects everyone—from corporations to individual households.

Fast Forward to 2025: What Could Happen Under Maganomics?

Economists are painting a worrying picture of what life might look like if these policies are implemented. Here’s what they predict:

- Slower Economic Growth: Labor shortages and rising debt could drag down economic productivity.

- Higher Inflation: Tariffs and reduced workforce availability could push prices higher, making it harder for families to afford necessities.

- Widening Inequality: Tax cuts favoring the wealthy could widen the gap between rich and poor, leaving middle-class families struggling to keep up.

How Maganomics Could Affect You

Imagine your local coffee shop closing its doors because it can’t afford higher supply costs. Picture your grocery bill rising each month while your wages remain stagnant.

For small business owners, tariffs and labor shortages could mean fewer customers and shrinking profits.

For working-class families, tax cuts for the wealthy might not translate into tangible benefits.

And for middle-class Americans, the rising cost of living could turn everyday expenses into financial burdens.

What Can Americans Do to Protect Themselves?

While we can’t predict exactly how Maganomics will play out, you can take steps to prepare:

- Stay Informed: Follow economic news and policy updates to understand what’s happening in real time.

- Get Involved in Politics: Your vote matters—both at the local and national levels.

- Plan Your Finances: Consider budgeting and saving to navigate potential price increases.

Final Thoughts

Trump’s Maganomics plan promises to reshape the U.S. economy, but at what cost?

Economists are worried that these policies could lead to slower growth, rising inflation, and greater inequality.

Will Maganomics be the boost America needs or a risky gamble that could push the economy into dangerous territory? The answer will shape the financial landscape for years to come.