In today’s job market, workers are increasingly setting their sights on a salary of $81,000 or more. This expectation comes amid rising inflation, a shifting economy, and concerns over job security.

Despite fears that automation and artificial intelligence (AI) could replace human workers, employees are standing firm in their wage demands.

Let’s explore why this specific figure has become the new standard and how it reflects the realities of modern life.

The Rising Cost of Living

One of the key reasons workers are demanding $81,000 is the increasing cost of living. Over the past few years, the prices of essentials like housing, food, transportation, and healthcare have soared.

In high-cost areas such as New York City, Los Angeles, and Washington D.C., living comfortably with lower wages is becoming increasingly difficult. For example:

- Housing: Rent prices in major metro areas have seen double-digit increases, with average rent for a one-bedroom apartment in cities like San Francisco and New York surpassing $3,000 a month.

- Food & Utilities: A simple grocery run now costs more than it did just a few years ago, with inflation pushing up prices across the board. Utility bills, including electricity, water, and internet services, have also risen.

- Transportation: Gas prices fluctuate wildly, and car maintenance is becoming a financial burden, especially with longer commutes.

With these increased expenses, $81,000 is now considered the bare minimum for employees to maintain a stable lifestyle without stretching their finances too thin.

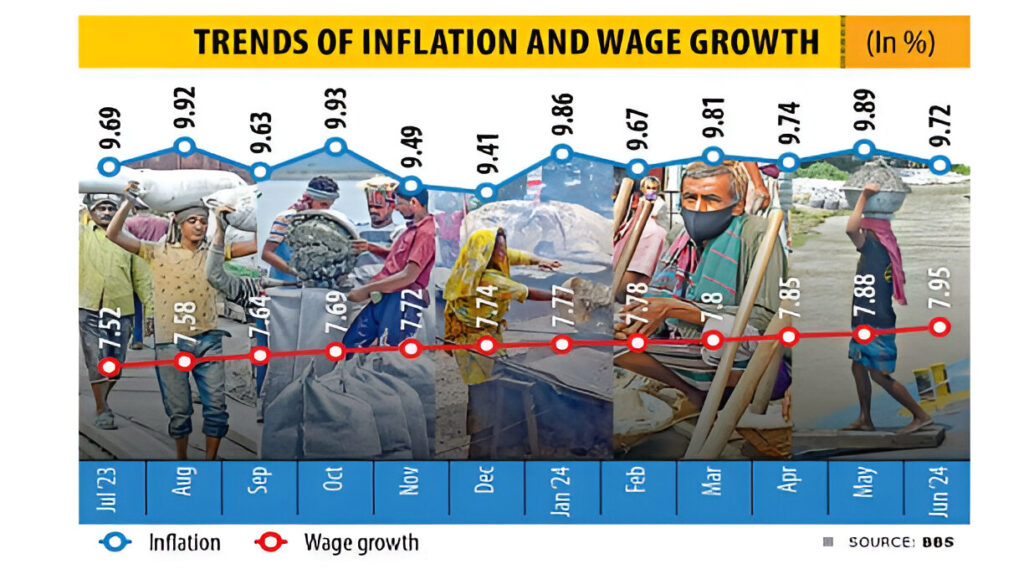

Inflation and Wage Growth

In the wake of the COVID-19 pandemic, inflation has surged to levels not seen in decades. While the cost of goods and services rises rapidly, wages have not kept up at the same rate.

According to the U.S. Bureau of Labor Statistics, wages in many industries have stagnated despite inflation.

For many workers, $81,000 represents an attempt to close the wage gap. It’s a figure that reflects the reality that what $50,000 could cover a decade ago no longer cuts it.

The buying power of today’s dollar is much weaker, and workers are demanding wages that reflect the current economic climate.

Job Security and Automation Fears

At the same time, job security is increasingly uncertain. Technology, particularly AI and automation, is changing the landscape of the workforce.

Many employees fear that their roles could be made redundant as companies turn to AI-driven tools to increase efficiency and cut costs.

Despite these concerns, workers are holding firm to their wage demands. They know that their skillset, in the current economy, is valuable.

The fear of being replaced by AI hasn’t caused workers to lower their salary expectations; instead, it has made them more assertive about the need to ensure they’re compensated fairly for the work they do.

Geography and Cost of Living Differences

While $81,000 might be a reasonable wage in high-cost areas, its purchasing power can vary greatly depending on where a person lives. For instance, someone living in a small town with a low cost of living (COL) may find that $81,000 allows them to live quite comfortably.

However, this amount might not stretch far in more expensive cities. In regions like San Francisco or Boston, $81,000 can barely cover rent and living expenses. Here’s a breakdown:

- Low-Cost Areas: In rural towns or regions with a low COL, $81,000 might cover all living expenses comfortably, allowing for savings and lifestyle upgrades.

- High-Cost Areas: In cities like Seattle or Los Angeles, $81,000 will often feel more like $50,000 after taxes and housing costs, especially if workers are paying off student loans, child care, or healthcare expenses.

This disparity has led to growing awareness that wage expectations should reflect the area in which a person works, making $81,000 the baseline for those living in high-cost regions.

The Pressure of Career and Life Demands

Beyond everyday expenses, there’s an added layer of pressure that comes from balancing career and life demands. For many, achieving a work-life balance has become a top priority.

Employees are no longer satisfied with simply getting by; they want to thrive. This includes being able to take care of their families, invest in their future, and enjoy life without the constant stress of financial insecurity.

For some workers, $81,000 is the minimum needed to:

- Pay for healthcare without fear of going bankrupt due to medical bills

- Save for retirement and emergencies

- Fund a child’s education or extracurricular activities

- Enjoy vacations or recreational activities to recharge and avoid burnout

The Shift Toward Employee Expectations

Ultimately, the demand for higher salaries, including the $81,000 threshold, marks a significant shift in how workers view their roles. They are no longer willing to accept wages that don’t align with the demands of modern living.

In industries where employees once accepted lower pay for the sake of job security, workers are now looking for compensation that reflects their contributions, expertise, and the high cost of living.

Conclusion

As the economy continues to evolve, workers’ demands for higher wages are likely to remain a key issue. The $81,000 figure may become a standard baseline, particularly in high-cost areas.

Employers will need to consider these changing expectations in order to attract and retain talent. For workers, this shift represents a necessary push toward fairer wages in a world where financial stability is no longer a given.

As inflation and living costs continue to rise, we can expect salary expectations to rise along with them.