The American Express Blue Cash Everyday card is suitable for those who want to earn cash back on their everyday spending, particularly at supermarkets, gas stations, and select department stores, without paying an annual fee.

What is American Express Blue Cash Everyday?

The American Express Blue Cash Everyday is a cash-back credit card offered by American Express. It’s designed for individuals looking to earn rewards on everyday purchases without paying an annual fee. It’s a perfect option for budget-conscious consumers looking to maximize their rewards on routine purchases.

Pricing

The financial details and pricing details of the American Express Blue Cash Everyday card are given below which helps you understand the costs and rewards associated with the card.

| Feature | Details |

|---|---|

| Annual Fee | $0 |

| Rewards Rate | – 3% cash back at U.S. supermarkets |

| – 2% cash back at U.S. gas stations and select U.S. department stores | |

| – 1% cash back on other purchases | |

| Welcome Offer | Varies (e.g., earn a $200 statement credit after spending $2,000 in the first 6 months) |

| Introductory APR | 0% on purchases for 15 months |

| Regular APR | 19.24% – 29.99% Variable |

| Balance Transfer Fee | N/A (Balance transfers are not available) |

| Late Payment Fee | Up to $40 |

| Returned Payment Fee | Up to $40 |

| Overlimit Fee | None |

| Cash Advance APR | 30.99% Variable |

| Cash Advance Fee | Either $10 or 5% of the amount of each cash advance, whichever is greater |

Features of Blue Cash Card

The American Express Blue Cash Everyday card offers a range of features designed to provide value to cardholders, particularly those who make frequent everyday purchases.

No Annual Fee

This card does not charge an annual fee, making it an attractive option for those who want to earn rewards without an additional cost.

Introductory APR Offer

On purchases for a specified period e.g., 15 months. After the intro period, the regular APR applies. This can help make large purchases and pay them off over time without incurring interest.

Welcome Bonus

New cardholders may receive a cash bonus if they meet a minimum spending requirement within the first few months of account opening.

Amex Offers

It offers access to special offers and discounts at various dealers, which can help you save money on dining, shopping, travel, and more.

Extended Warranty

It adds up to an extra year of warranty coverage on suitable purchases with original warranties of 5 years or less.

Return Protection

If a dealer won’t take back an eligible item within 90 days of purchase, American Express may refund the purchase price up to a certain amount per item and per year.

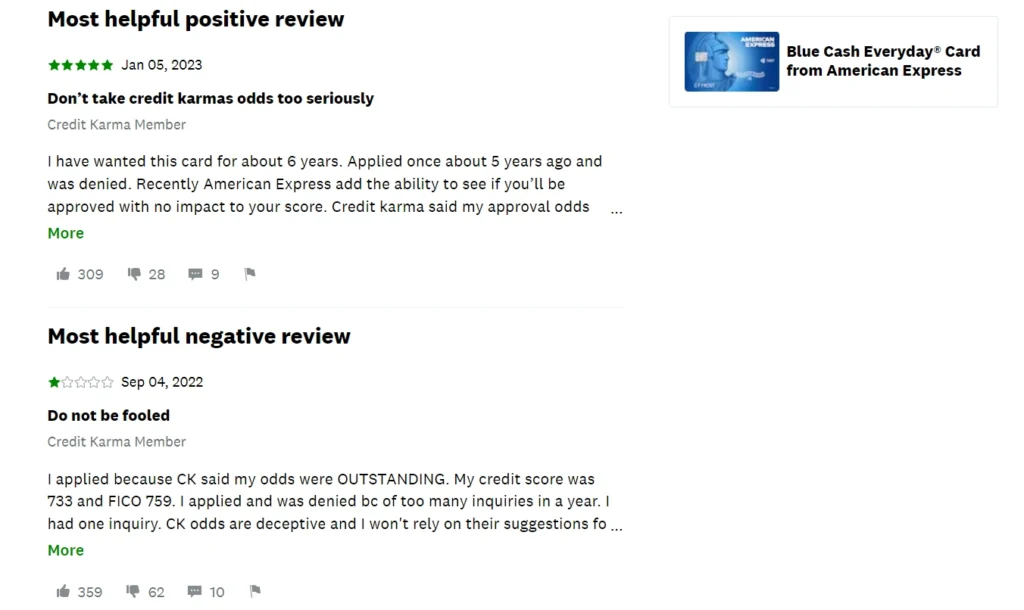

Reviews On Blue Cash Card

The reviews on American Express Blue Cash Everyday are both negative and positive given by the users. Users appreciate the lack of an annual fee, which improves the value of the cash-back rewards. While some users said the $6,000 annual cap on the 3% cash back categories is seen as a limitation for high spenders.