President Trump’s announcement of new tariffs on Canada, Mexico, and China has sparked fierce debates and rising concerns.

In this article, we dive deep into how these tariffs might reshape the American economy, using active storytelling and clear insights to guide you through the potential impacts.

Tariffs: A Bold Move with Big Consequences

President Trump plans to impose a 25% tariff on goods from Canada and Mexico, along with a 10% tariff on Chinese products.

He aims to protect American jobs and curb illegal immigration and drug smuggling.

Yet, many experts warn that these tariffs could backfire.

They argue that the new taxes will push costs onto U.S. consumers and businesses, creating a ripple effect that reaches far beyond the trade desk.

Rising Prices: Consumers Feel the Pinch

Imagine heading to your local grocery store and finding that your favorite fruit now costs more. That scenario may soon become a reality.

When tariffs increase the cost of imported goods, businesses often raise prices to cover extra expenses. This means:

- Everyday Essentials: Groceries, clothing, and electronics could all see higher price tags.

- Building Materials: Items like lumber and cement imported from Canada may cost more, affecting home construction and renovations.

- General Inflation: As costs rise, you might notice a steady increase in the prices of many everyday items.

Consumers may find their monthly budgets squeezed as they face these rising prices.

How U.S. Businesses Are Dealing with Rising Costs and Uncertainty

Businesses that rely on imports from Canada, Mexico, and China must adjust quickly. They now face higher costs for raw materials and components. Companies respond in several ways:

Many firms will pass increased costs onto customers, making goods less affordable.

To cope with higher expenses, companies might reduce their workforce or delay investments.

Some businesses may seek new suppliers or domestic alternatives, though this transition can take time.

These adjustments could slow down economic growth and put American jobs at risk, as companies struggle to balance higher costs with competitive pricing.

The Story of a Trade War in the Making

The tariffs have stirred a global response. Countries like Canada, Mexico, and China plan to retaliate, setting the stage for a potential trade war. Here’s what happens next:

- Canada’s Retaliation: Canadian officials promise a “forceful but reasonable” response, targeting products like Florida orange juice.

- Mexico’s Preparedness: Mexican leaders reveal that they have multiple countermeasures ready, prepared to defend their interests.

- China’s Caution: China warns that any escalation could hurt the global economy, emphasizing that no one wins in a tariff war.

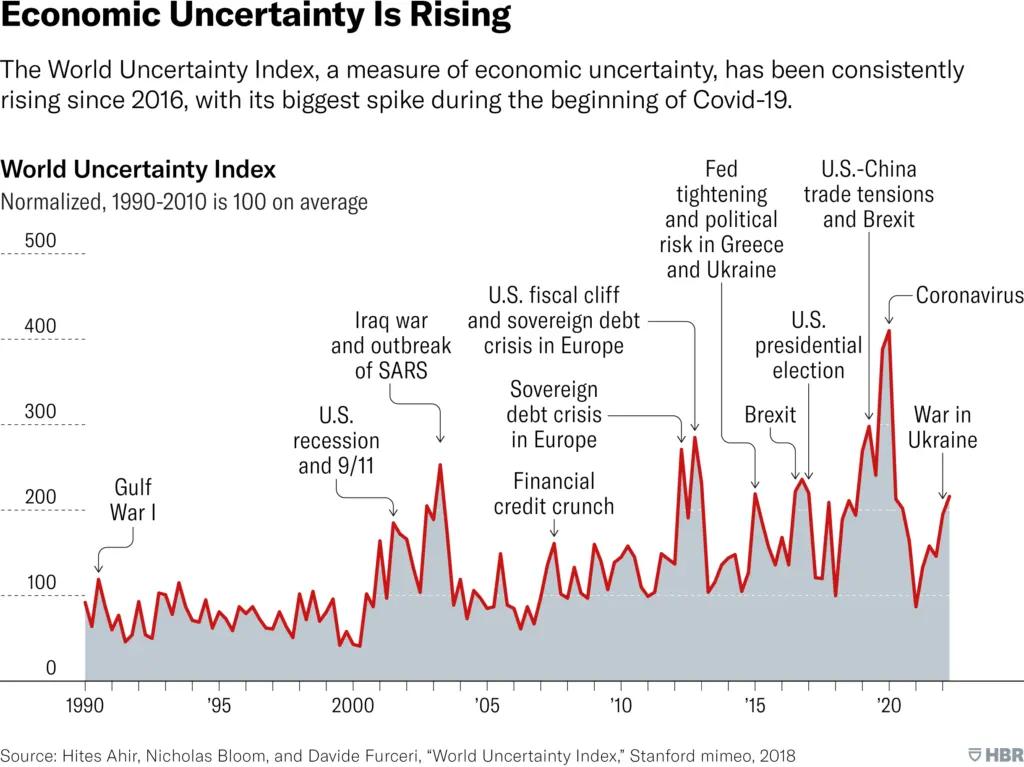

This international pushback adds uncertainty to global markets and makes it hard for businesses to plan for the future.

Stock Market Takes a Hit After New Tariff Announcement

Almost immediately after President Trump announced the tariffs, the stock market took a hit.

Major indexes like the Dow Jones Industrial Average, NASDAQ, and S&P 500 dropped sharply. Investors reacted to the possibility of higher costs and slower economic growth.

This immediate downturn signals that the market views these tariffs as a risky move, highlighting the volatile intersection of politics and economics.

Preparing for a Changing Economic Landscape

While the tariffs create uncertainty, you can take practical steps to protect your finances and stay informed:

- Budget Wisely: Prepare for higher prices on everyday items and adjust your spending accordingly.

- Support Local Products: Buying American-made goods can help reduce reliance on imported products and support local industries.

- Stay Updated: Follow reliable news sources to learn about new developments and understand how global events might affect your wallet.

Final Thoughts

President Trump’s tariff threats send a powerful message: the U.S. is ready to take a stand against unfair trade practices.

However, these tariffs also risk increasing prices for consumers, raising costs for businesses, and triggering retaliatory actions from trading partners.

As the global economy reacts, we may soon experience a cascade of changes—from higher grocery bills to a more uncertain job market.